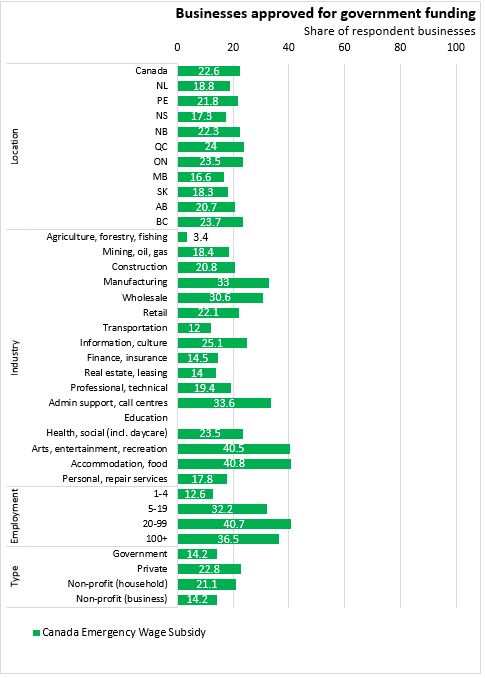

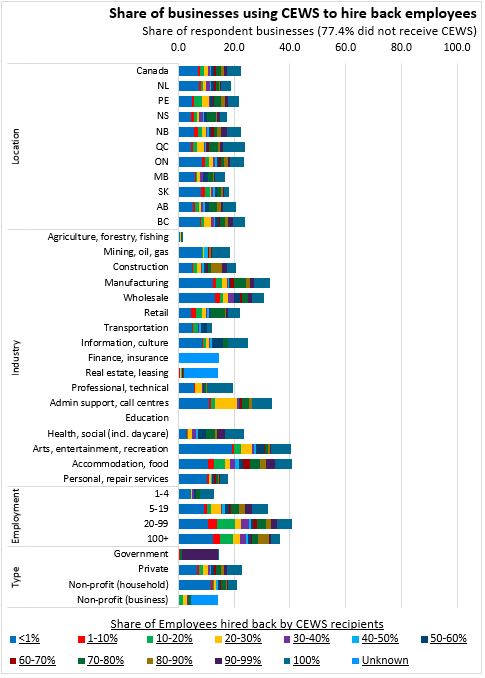

Cews Chart

The cews should be phased out gradually in terms of both the revenue test for specific employers and more generally.

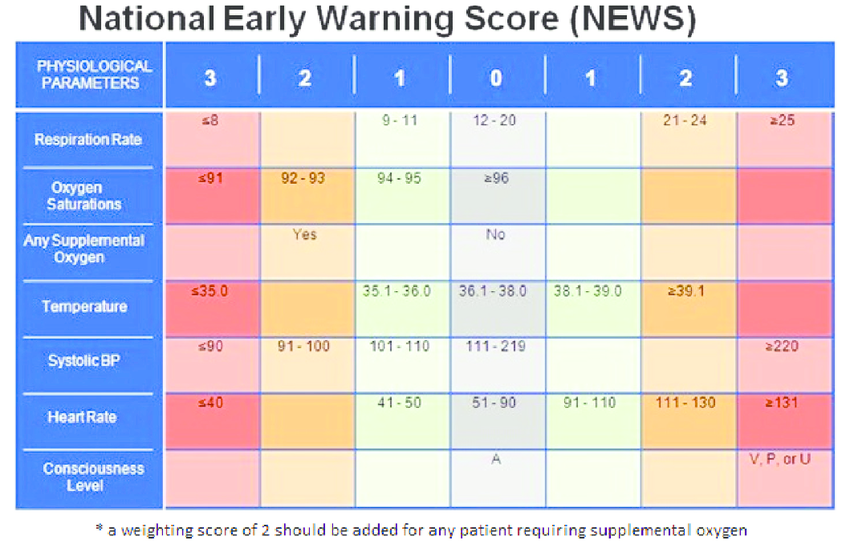

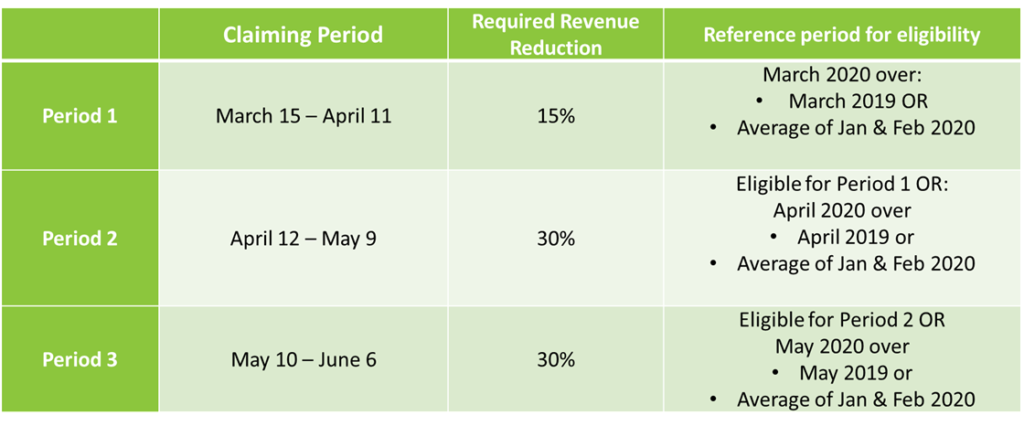

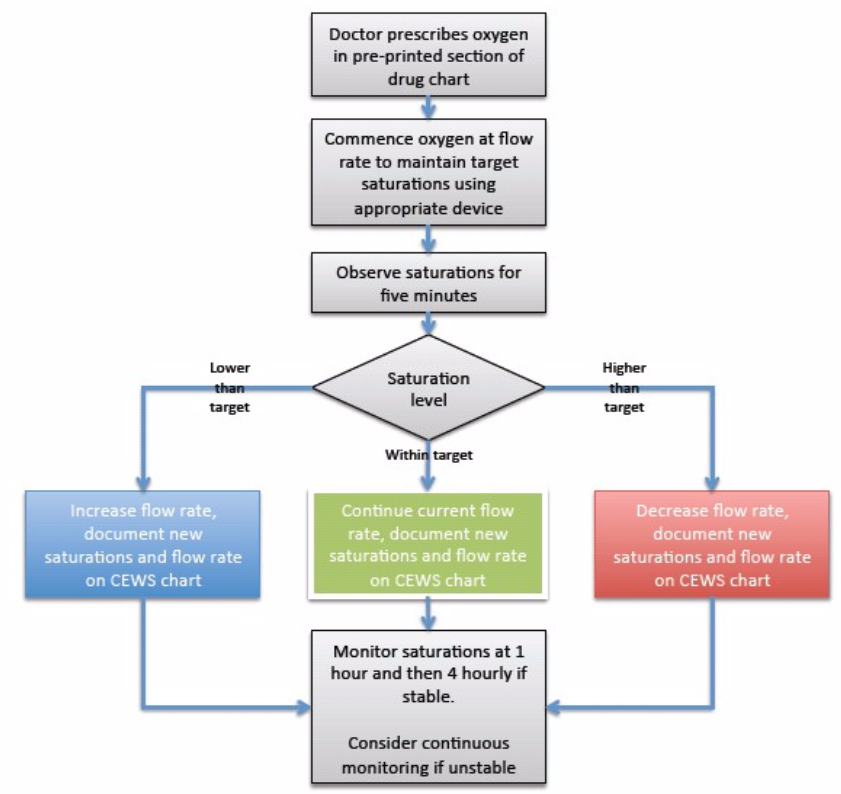

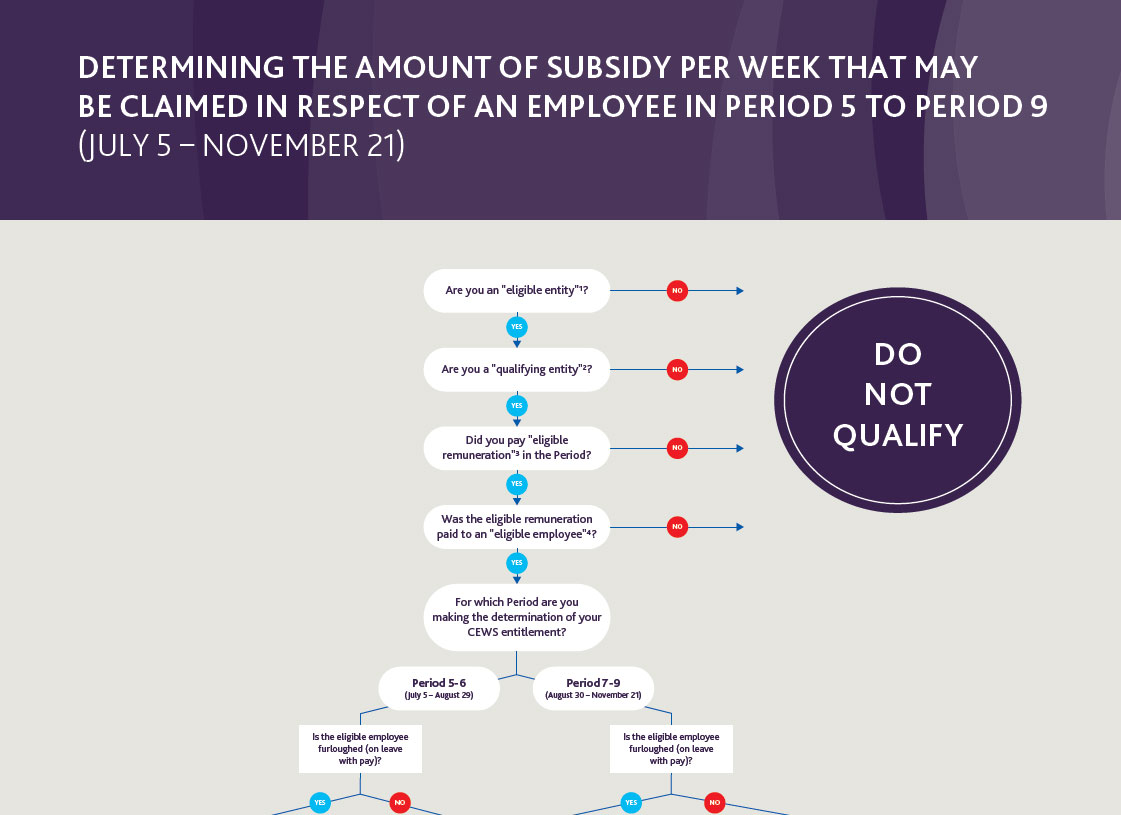

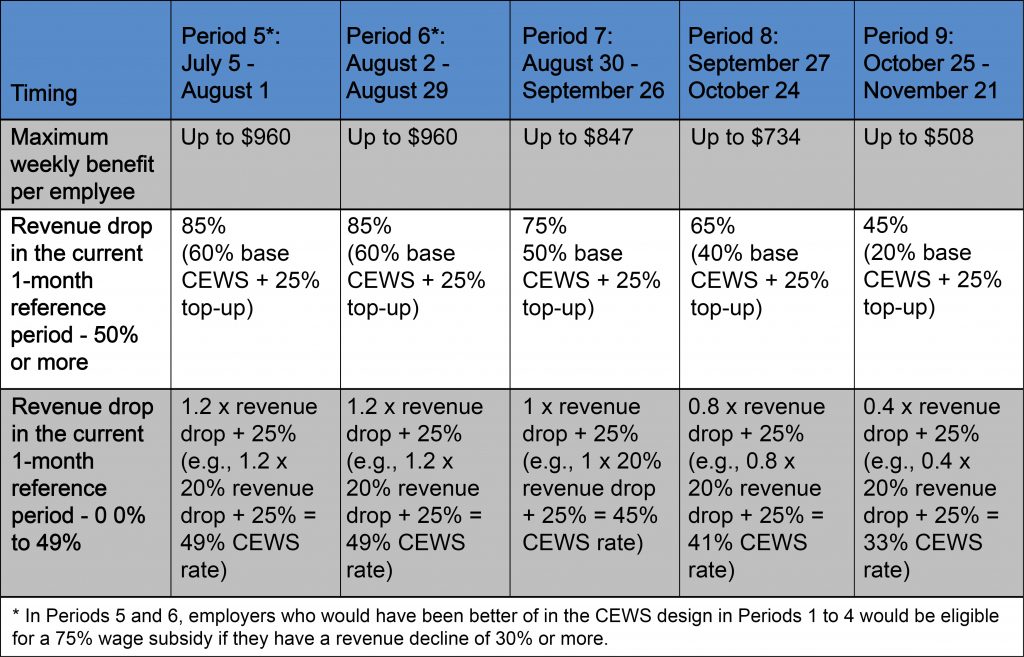

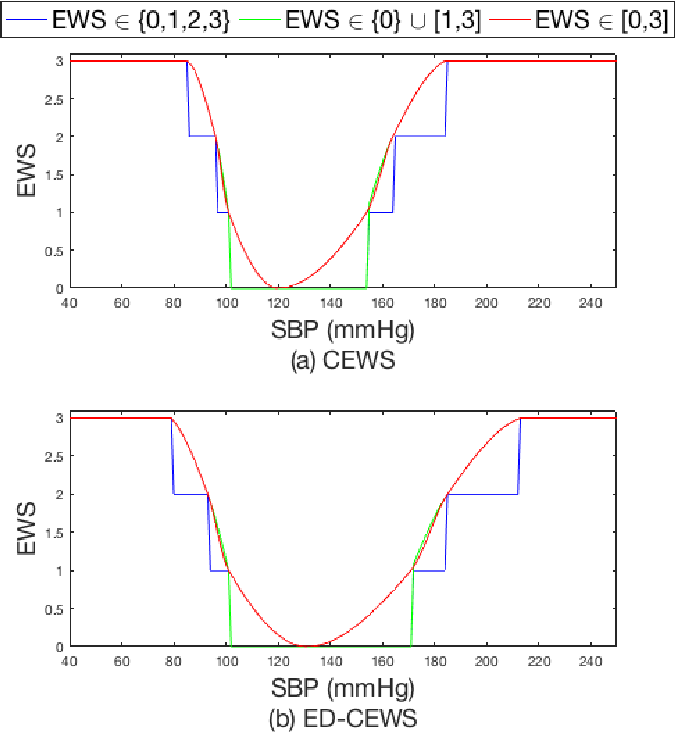

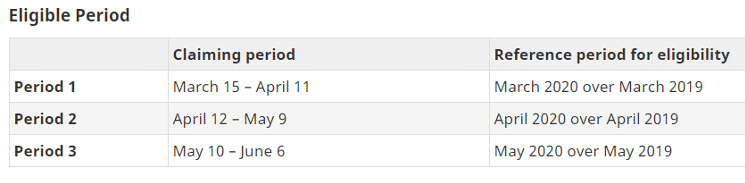

Cews chart. Applications for claim period 5 july 5 to august 1 will open august 17 2020. Score 1 cews 1 2 inform nurse in charge cews 3 4 inform ward doctor cews 5 6 inform registrar cews 7 place 2222 call see reverse of form for descriptions of actions date time respiratory rate 56. The attached flowchart is designed to assist employers in determining eligibility and applicable cews rates for each of the qualifying periods as of july 5th 2020 and includes relevant definitions and charts.

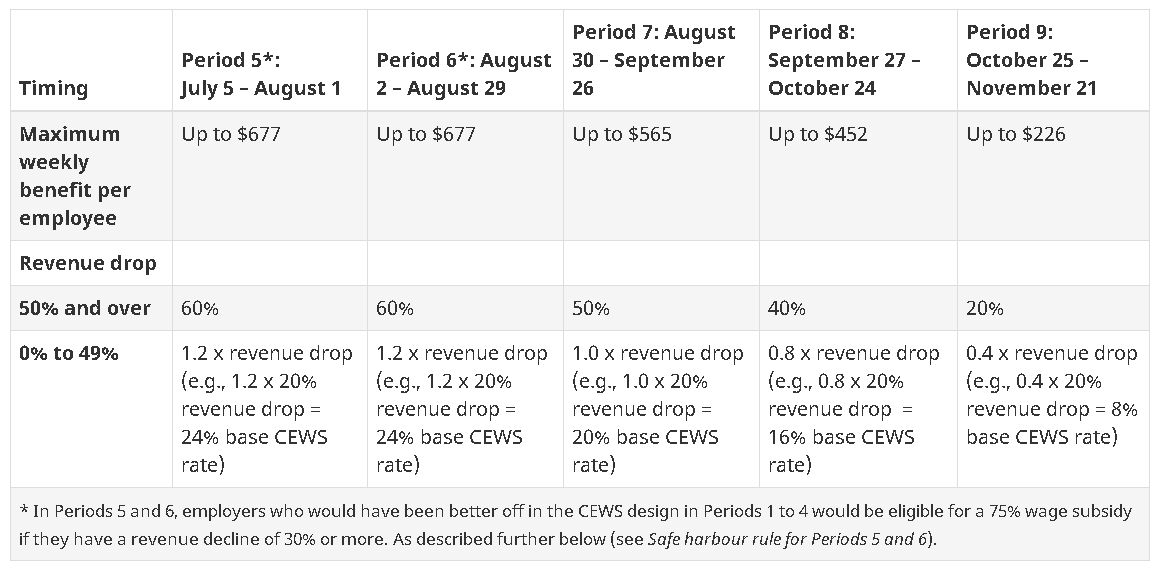

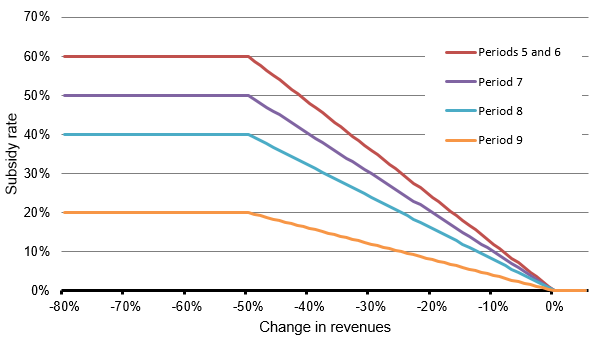

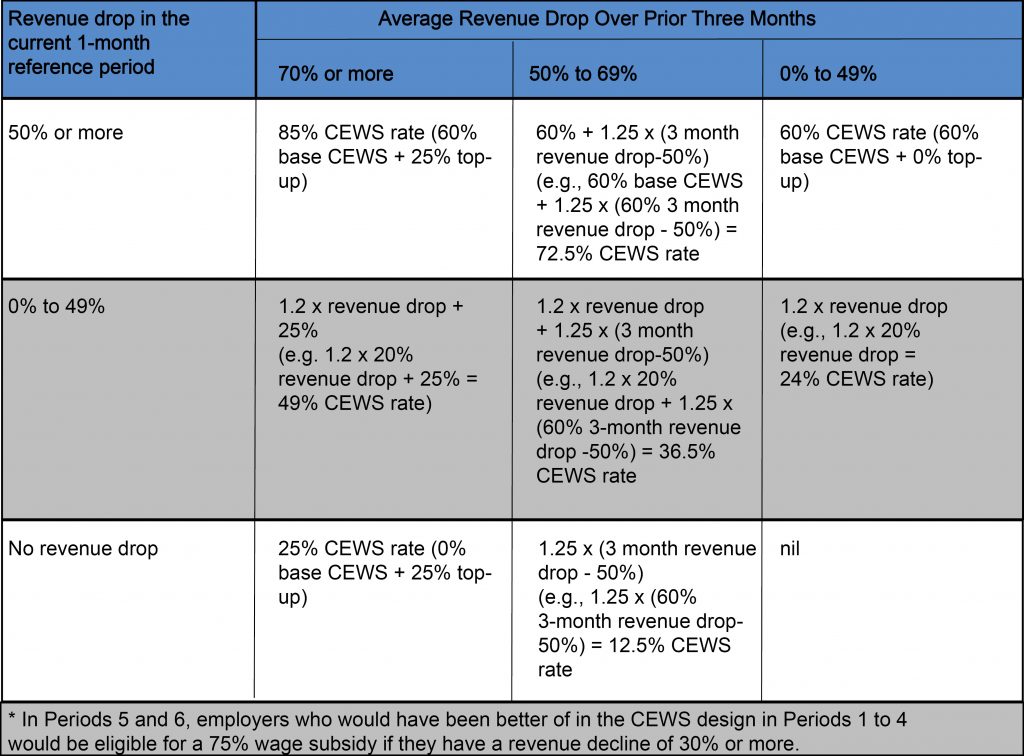

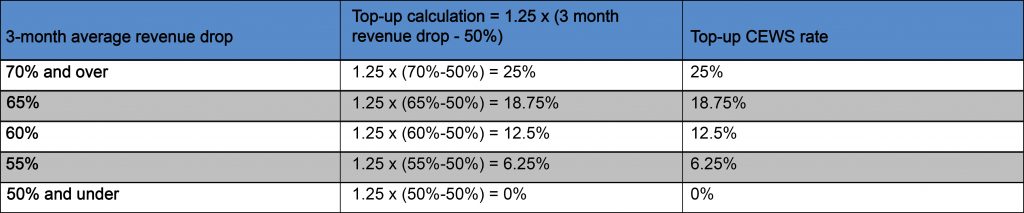

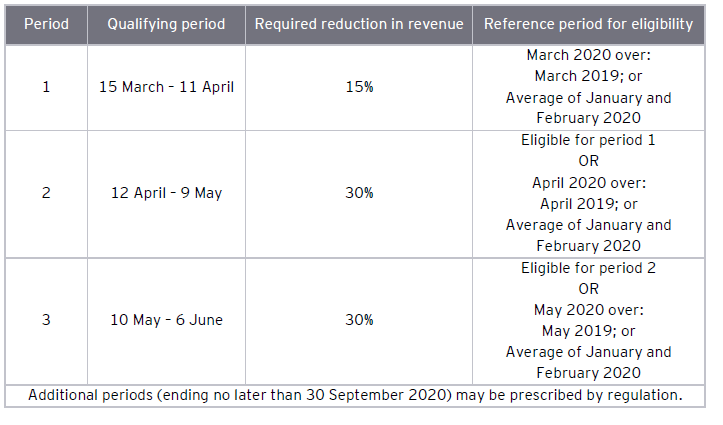

On july 17 2020 the federal tabled draft legislation for more changes to the canada emergency wage subsidy cews program. Under the proposed legislation equal to 1 25 the average revenue drop in excess of the 50 to a maximum of 25 per the chart below. In essence the changes would make the program more accessible to businesses introduce a two part new subsidy system and extend the program until the end of the year.

The base calculation is on a sliding scale and is for anyone with any amount of revenue drop even 1 2. We estimate that 75 of small business owners or more will now qualify. For example if the revenue drop in period 5 using either the general approach or the alternative approach is 40 per cent the base subsidy.

How is the top up subsidy rate calculated. The proposed changes would extend the cews until december 19 2020 including redesigned program details until november 21 2020. For example if the revenue drop in period 5 using either the general approach or the alternative approach is 40 per cent the base subsidy rate is 48 per cent 1 2 40.

On july 17 the government announced proposed changes to the cews. More information will be coming soon. Cews 2 0 includes a base subsidy and a top up subsidy.

Elections under subsections 125 7 1 or 125 7 4 of the cews program rules. The chart below sets out the rate formula and comparison periods for periods 5 to 9. With cra we are putting together materials to help small businesses calculate the new cews.

The chart below sets out the rate formula and comparison periods for periods 5 to 9. As a canadian employer whose business has been affected by covid 19 you may be eligible for a subsidy of 75 of. Then indicate which election s.

Choose yes if you and all required participants in the election have made any elections or choices referred to below as elections for revenue calculation under subsections 125 7 1 or 125 7 4 of the cews program rules.